News and Promotions

High-Rate CDs

A Safe Harbor for Your Savings

For nearly 100 years, POCUMD has been a trusted financial guide for our members and their families. Like a lighthouse steering ships safely to shore, you can trust us to safeguard your savings with strength, stability, and experience.

Limited-Time CD Rates

9-Month CD – 4.25% APR*

12-Month CD – 4.00% APR*

$500 Minimum deposit

Limited time only

How to Open Your CD

Call: 410-727-5469 - We can open your CD over the phone.

Email: info@pocumd.org - Let us know you’re interested in opening a CD, and a Customer Care Rep. will contact you within 24 business hours.

In Person: Visit the branch at 900 East Fayette St., Suite 606, Baltimore, MD 21233. We are open Monday - Friday between 8:00 AM and 4:00 PM

Request Form: Complete the form below. Select Submit. A Customer Care Rep will contact you within 24 business hours.

POCUMD membership is required to open a Certificate of Deposit.

Click on “How to Join” for information about POCUMD Membership.

Auto Loan Special - 2.99% APR

2.99%* on NEW, USED or REFINANCED

Hit the road with a new car and a great low rate from POCUMD! With no payments for 90 days, you can cruise into the new year payment-free while enjoying the lowest rates in Maryland.

Whether you’re buying new, upgrading your current ride, or refinancing from another lender, now’s the perfect time to save big and start fresh.

Don’t wait — this special offer ends March 31, 2026.

Apply online today and drive into the new year with extra holiday cheer!

Terms up to 72 Months

No payments for 90 days

Apply online in minutes

Pre-approval within 48 hours

Quick access to funds

With our online application system, you can easily apply for an auto loan from the comfort of your home or on the go. Say goodbye to lengthy paperwork and endless waiting. POCUMD ensures that your application is processed swiftly, getting you one step closer to driving off in your desired vehicle.

* 2.99% rate is for well-qualified POCUMD members only. Maximum loan terms apply - 72-month term maximum. Rates for 84 months available. Quoted APRs are subject to change daily at the discretion of the Board of Directors. APR may vary based on creditworthiness, income, and term of loan. Rates indicated are the lowest rates available. Leased vehicles and existing POCUMD loans are not eligible. Limited-time offer runs from 10/1/25 - 3/31/26.

* APR is the Annual Percentage Rate. Quoted APRs are subject to change daily at the discretion of the Board of Directors. APR may vary based on creditworthiness, income, and term of loan. The rates indicated are the lowest rates available. For example, a $50,000 new car auto loan with a 48-month term with a fixed rate of 3.09% APR will result in an estimated monthly payment of $22.18 per $1,000. Contact Credit Union for details. Good on all qualified automobiles with approved credit. Vehicles financed through dealer with 0% financing not eligible. Leased vehicle and existing POCUMD loans are not eligible. Open to members aged 18 or older in good standing, who have made all loan payments on time on the vehicle in question and are eligible under POCUMD underwriting guidelines. Verification of income required. 3.29% APR only available on new 2026, or 2025 vehicles with less than 5,000 miles. 3.49% APR available on 2025-2019 vehicles. Maximum loan terms apply (60-month term maximum. Rates for 72-84 months available). Credit Union reserves the right to extend payments over the longest term to lower payments. This may impact the interest rate of the loan. Limited time offer runs from 1/1/26-3/31/26.

Debt Consolidation Loan - 9.55% APR*

One Simple Loan. One Low Rate. More Peace of Mind.

Managing multiple credit cards can feel overwhelming. With our Debt Consolidation Solutions Loan, you can combine higher-rate balances into one easy monthly payment—making it simpler to stay on track and move forward with confidence.

Whether you’re paying down credit cards or other unsecured debt, we’re here to help you simplify and save. Our Debt Consolidation Loan helps you regain control of your finances by merging your debts into one easy-to-manage payment.

One payment. One due date. One clear solution!

Loan Amount: $3,000 to $25,000

Terms: 12 - 60 months

No payment for 90 days

Pre-approval in 48 hours

Getting Started Is Easy

Apply online in minutes, and see how quickly consolidating your debt can make a difference.

Click on the link to apply online - or - complete and submit a printed application form.

To submit your completed printed application form chose any of the following methods:

Mail: Post Office Credit Union of MD, P.O. Box 22911, Baltimore, MD 21203

Fax: [410] 727-0929

Email: loans@pocumd.org

In Person: 900 E. Fayette St., Suite 606, Baltimore, MD 21233

If you have any questions or need help, contact us at 410-727-5469 or info@pocumd.org. We're here to help!

* PERSONAL LOANS. APR is Annual Percentage Rate. Promotional rates are for well qualified members. Rates indicated are the lowest rates. Quoted APRs are subject to change daily at the discretion of the Board of Directors. Open to all members who are eligible under current POCUMD underwriting guidelines. Limited-time offer. Valid 1/01/26 - 3/31/26. Contact Credit Union for additional details.

New - Debt Protection with LifePlus

Financial Protection for the Unexpected

Your family means everything to you. And if the unexpected happens, you don’t want an emotionally trying situation to be compounded by financial worry. That’s why we now offer DEBT PROTECTION, which CANCELS ALL OR PART OF YOUR LOAN, up to the maximum specified in your contract.

Debt Protection Covers:

Involuntary unemployment

Disability

Death

Life Plus Adds Extra Protection for:

Accidental dismemberment

Terminal illness

Hospitalization or family medical leave

Death of a non-protected dependent

Key Benefits:

Easy to apply and starts immediately.

Affordable, fits into your monthly payment.

Peace of mind in various challenging situations.

Important Notes:

It’s optional and doesn’t affect your loan application or terms.

You can cancel anytime, with a full refund if canceled within 30 days.

Eligibility requirements and exclusions apply—ask for details.

Take a step toward financial security.

Applying for a loan? Remember to ask about Debt Protection with Life Plus today!

POCUMD Credit Card - 0.00% APR!

Enjoy A Low 0.0% APR introductory rate for the first six months.

Take advantage of low rates, great rewards, and the convenience of carrying a card backed by your trusted credit union.

0.0% APR intro rate for the first six months

Choose from two card options - Value card or Rewards card

No annual fees

Robust reward programs

Fast and easy online application

Apply for your new credit card today!

The POCUMD Credit Card is also available to non-members. Tell your friends and family about this great credit card offer and apply for their own POCUMD Mastercard® today.

Our Card Holder Assistance team can answer all your questions! Call 888-450-1842.

* Terms apply. For questions contact Card Holder Assistance at 888-450-1842. 24 hours a day, 7days a week, 365 days a year.

4th Quarter 2025 Membership Message

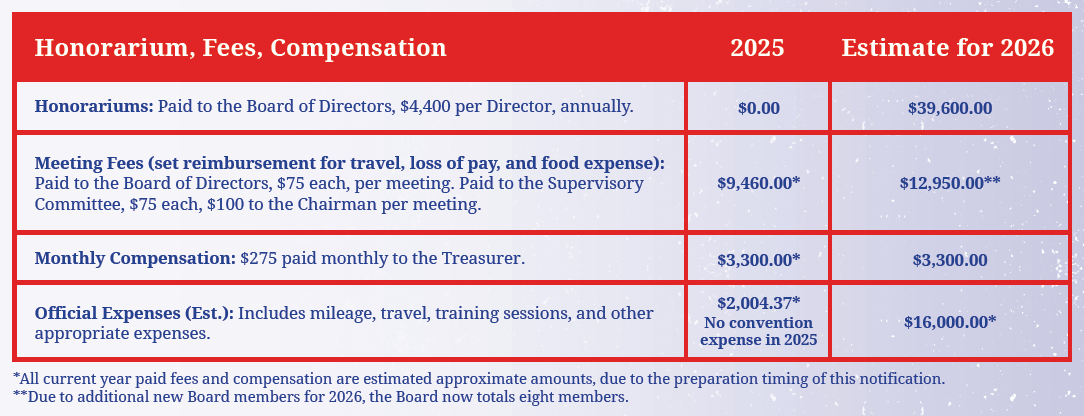

Board of Directors and Supervisory Committee Honorarium, Fees, Compensation, and Elections

Each year at the Post Office Credit Union of Maryland’s Annual Meeting, the members are asked to approve the prospective honorariums and compensation to be paid that calendar year to the volunteers who serve on the Board of Directors and the Supervisory Committee.

The honorariums and meeting fees are considered tokens of appreciation for those individuals who serve the credit union in a voluntary capacity, which in turn help defray the costs of travel in attending meetings on behalf of the credit union. Listed on the reverse side is a summary of the payments that were made payable to these volunteers in 2025. The membership will be asked to propose and approve these fees for the calendar year 2026.

Any member interested in running for the Board of Directors, who meets the State of Maryland’s qualifications, passes a background check, a bond check, a credit review, is over the age of majority, and has been a member of the credit union for five consecutive years, please contact Joseph Amellio, CEO, at the credit union to receive the candidate qualifications and background forms. The cut-off for filing these forms will be noon on Friday, February 13, 2026. Any applications received will then be reviewed, and those who meet or do not meet the qualifications will be notified of the outcome. In the event that the number of board nominees submitted is the same as the number of board positions to be filled, then the election will not be conducted by ballot. Instead, the open board positions will be filled by an equal number of nominees. At no time will nominations be accepted from the floor.

Account-To-Account (A2A) Transfers

The convenient way to move money between your accounts at different financial institutions.

Why you’ll love A2A Transfers

Fast and Convenient - No need to visit the branch or write a check.

Stay in Control - Move money when you need it, with flexible scheduling for one-time or recurring transfers.

Safe & Secure - Your transactions are protected with the highest security standards.

Manage All Your Accounts - Connect your accounts at other banks and credit unions for effortless money movement.

Whether you’re paying bills, saving for a goal, or just managing your finances, A2A transfers make it simple.

How to get started.

Step 1 - Log into Online Banking using your username and password.

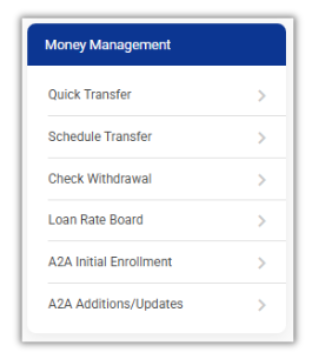

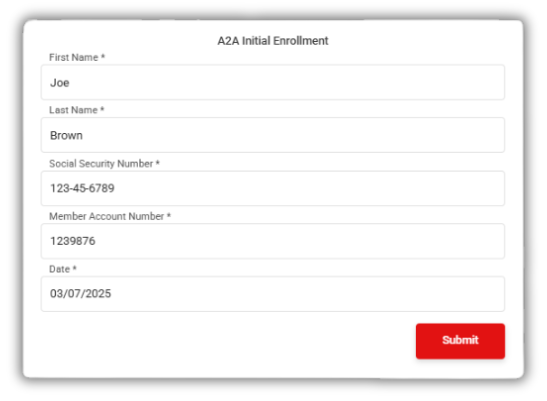

Step 2 - Once logged in, go to the Money Management section. Select “A2A Initial Enrollment”.

Step 3 - Complete the enrollment request form and select “Submit”.

Once we receive your request, we will send you the official enrollment forms to sign and return to the credit union. After you’re set up in our system, you’ll be ready to transfer funds with ease! You can also add or update any of your financial institutions’ information by selecting “A2A Additions/Updates” from the Money Management window.

Give us a call at (410) 727-5469 if you need assistance getting started or have any questions.

FREE POCUMD Membership

Share the Gift of Membership with our FREE Membership Offer.

We’re making it easier than ever for you and your family to enjoy the benefits of POCUMD membership.

From now through March 31, 2025, we’re waiving the $10.25 membership fee. Don’t miss this opportunity to unlock low rates, exclusive benefits, and the personalized service you deserve — all for free!

Apply online in minutes or complete the application form and mail, fax, email, or stop by the branch to drop it off.

To join the credit union, please apply online. or complete the Membership Application form and return it to us via:

Mail - P.O. Box 22911, Baltimore, MD 21203-4911

Fax - 410-727-0929

Email - info@pocumd.org

Drop it off - POCUMD branch location at 900 East Fayette St., Room 606, Baltimore MD 21233

Any questions, give us a call at (410) 727-5469. We’d love to help!

Already a member?

Share the gift of membership with your family members.

As a POCUMD member, you already enjoy great rates and exclusive benefits. Share the love and encourage your family to join our community. It only takes a few minutes to join online. POCUMD membership is open to all Maryland USPS employees and their families.

TruStage Insurance Services

Paying too much for Insurance?

You work hard for your money and to keep your budget on track. So why spend more than you have to for insurance you need to protect you and your family? Post Office Credit Union of Maryland members may qualify for discounts on insurance through TruStage.

TruStage works with national companies to help members save without losing any money. And when you save big, it can be easy to switch insurance carriers!

TruStage Products Available to POCUMD Members:

Auto and Home Insurance

Life Insurance

Accidental Death and Dismemberment Insurance - Members receive $1000 at no cost.

TruStage offers a powerful mix of savings and popular, member-friendly benefits:

Credit union member discounts

Nationally recognized companies (Liberty Mutual, CMFG)

Friendly, 24/7-service – even on holidays

With over 20 million protected under their coverages, it’s an established firm that you can trust to protect and add value.

Check our TruStage page for program information and free quotes. Or visit the Post Office Credit Union of Maryland TruStage website page.

Mobile App

Bank on the Go with Our Mobile App

It's never been easier to keep an eye on your finances. In fact, there's an app for that!

Simply search "POCUMD" in Google Play or the Apple App Store to download the official Post Office Credit Union of Maryland app.

Enhanced with more features!

Downloading the app will put your POCUMD account details in your hands. There are so many benefits.

View balances and transfer funds

Mobile check deposits (coming soon)

Open and fund new accounts

Apply for loans

Sign up for e-Statements and Text Banking

Find surcharge free ATMs

Request check withdrawals

Change your address or phone number

Contact YOUR credit union!

Get out your devices and download today!

Online Banking

Bank from Anywhere – Anytime!

Are you ready to take your banking to the next level? With POCUMD Online Banking, managing your money has never been easier—or more convenient!

This FREE service lets you:

Check your balances

View recent transactions

Download monthly statements

Transfer money in seconds

Apply for loans right from your screen

and so much more—all with just a few clicks!

It’s fast. It’s easy. It’s eco-friendly.

Whether you're at home, at work, or on the go, POCUMD Online Banking keeps you connected to your finances 24/7.

Don't wait—log in or enroll today and experience the freedom of online banking!

Questions? We're happy to help—just give us a call at (410) 727-5469.

Message to our Members Retiring from the Post Office

Congratulations on your retirement from the Post Office! You have arrived at an important milestone in your life. You can now stop living to work, and begin working to live!

We also want to thank you for being a loyal member of POCUMD. Remember, retirement from the Post Office does not affect your membership eligibility with the credit union. Once a member, always a member!

To transition smoothly into retirement, please call OPM at 1-888-767-6738 (TDD 1-800-878-5708), Monday - Friday, 7:30 a.m. - 7:45 p.m. Eastern Time to update your allotments. You will need the credit union's routing number (#252076578), followed by your account number. If you do not have the routing number, contact us, and we will provide it for you.

Our friendly staff is more than happy to assist you with any questions or concerns. Call us at (410) 727-5469, Monday - Friday, 8:00 a.m. - 4:00 p.m.

Once again, congratulations on your retirement, and be sure to make good use of your membership with POCUMD. Why not share your secret? Membership is available to all family members! Open an account for your spouse, children, grandchildren, or any other family member.

Note: There is no limit on the amount you may deposit into any of your accounts.

Newsletters

Our newsletters are available in PDF format. PDF is a universal file format that preserves the fonts, images, graphics, and layout of any source document, regardless of the application and platform used to create it. For more information on PDF format, please visit www.adobe.com. Download the latest version of Adobe Reader.