News and Promotions

Celebrating our 96th Annual Meeting

We were thrilled to welcome over 100 members and guests to our 96th Annual Meeting at Jimmy’s Famous Seafood!

It was a wonderful evening of connection, appreciation, and celebration.

Thank you to all who attended—we look forward to seeing you again next year!

Auto Loan Special - 2.99% APR*

2.99% APR on NEW, USED, or REFINANCED Auto Loans

Now’s the time to take advantage of our exclusive Spring Auto Loan Special, featuring an unbeatable 2.99% APR for up to 72 months! Whether you’re looking to purchase a new or used vehicle or are interested in refinancing your current auto loan, we have you covered.

2.99% APR* - up to 72 months of financing

No payments for the first 90 days

Flexible terms up to 80 Months

Pre-approval in 24 hours

Limited time offer

Apply Now. Limited time offer!

With our online application system, you can easily apply for an auto loan from the comfort of your home or on the go. Say goodbye to lengthy paperwork and endless waiting. POCUMD ensures that your application is processed swiftly, getting you one step closer to driving off in your desired vehicle.

* 2.99% rate is for well-qualified POCUMD members only. Maximum loan terms apply (60-month term maximum. Rates for 72-84 months available). Quoted APRs are subject to change daily at the discretion of the Board of Directors. APR may vary based on creditworthiness, income, and term of loan. Rates indicated are the lowest rates available. Leased vehicle and existing POCUMD loans are not eligible. Limited-time offer runs from 4/1/25 - 7/15/25.

* APR is the Annual Percentage Rate. Quoted APRs are subject to change daily at the discretion of the Board of Directors. APR may vary based on creditworthiness, income, and term of loan. The rates indicated are the lowest rates available. For example, a $50,000 new car auto loan with a 48-month term with a fixed rate of 3.09% APR will result in an estimated monthly payment of $22.18 per $1,000. Contact Credit Union for details. Good on all qualified automobiles with approved credit. Vehicles financed through dealer with 0% financing not eligible. Leased vehicle and existing POCUMD loans are not eligible. Open to members aged 18 or older in good standing, who have made all loan payments on time on the vehicle in question and are eligible under POCUMD underwriting guidelines. Verification of income required. 3.29% APR only available on new 2025, or 2024 vehicles with less than 5,000 miles. 3.49% APR available on 2024-2018 vehicles. Maximum loan terms apply (60-month term maximum. Rates for 72-84 months available). Credit Union reserves the right to extend payments over the longest term to lower payments. This may impact the interest rate of the loan. Limited time offer runs from 4/1/25-7/15/25.

Bi-Annual Verification of Accounts

Notice of the POCUMD Supervisory Committee 2025 Verification of Accounts

The Supervisory Committee will conduct its bi-annual account verification in July 2025. We kindly ask that you carefully review your June 2025 account statement upon receipt in early July.

If you identify any discrepancies, please report them to the Supervisory Committee within 30 days. A Notification Form and a return envelope will be included with your June 2025 statement for your convenience.

*For members that receive eStatements, the address to send the form to is: Supervisory Audit Committee, PO Box 441, Baltimore, MD 21203-0441

No action is required if your records are accurate. Contact the Credit Union at 410-727-5469 if you have any questions.

Account-To-Account (A2A) Transfers

Simplify your money moves with our NEW Account-to-Account transfers.

We’re excited to introduce our new Account-to-Account transfers - a convenient way to move money between your accounts at different financial institutions.

Why you’ll love A2A Transfers

Fast and Convenient - No need to visit the branch or write a check.

Stay in Control - Move money when you need it, with flexible scheduling for one-time or recurring transfers.

Safe & Secure - Your transactions are protected with the highest security standards.

Manage All Your Accounts - Connect your accounts at other banks and credit unions for effortless money movement.

Whether you’re paying bills, saving for a goal, or just managing your finances, A2A transfers make it simple.

Here’s how to get started.

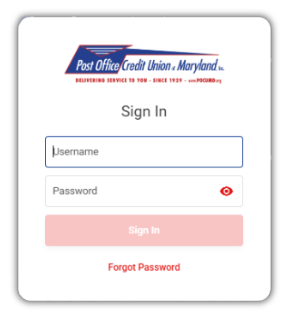

Step 1 - Log into Online Banking using your username and password.

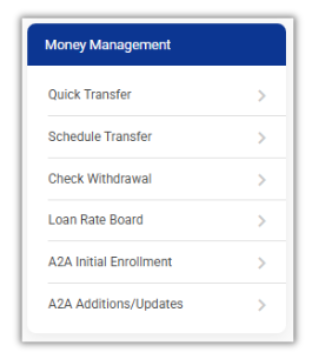

Step 2 - Once logged in, go to the Money Management section. Select “A2A Initial Enrollment”.

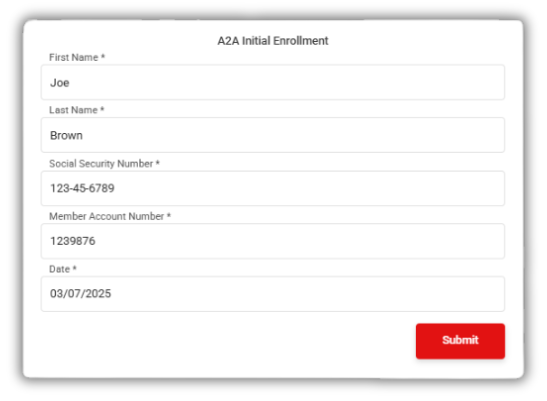

Step 3 - Complete the enrollment request form and select “Submit”.

Once we receive your request, we will send you the official enrollment forms to sign and return to the credit union. After you’re set up in our system, you’ll be ready to transfer funds with ease! You can also add or update any of your financial institutions’ information by selecting “A2A Additions/Updates” from the Money Management window.

Give us a call at (410) 727-5469 if you need assistance getting started or have any questions.

Home Improvement Loan - 8.55% APR*

Big or small, we fund it all!

Interior Renovations, Yard Makeovers, New Appliances, Home Repairs, Basement Finishing, New Windows, and More…

Looking to transform your home? Whether it’s a dream renovation or a small upgrade, we make it happen with our Home Improvement Loan - the easiest way to get the funding you need!

Borrow up to $20,000

Flexible 60-month terms

Quick and easy online application

Pre-approval in 24 hours

90 days - No pay!

*8.55% APR - Promotional rate when you open a checking account with a debit card and set up a min. $100 direct deposit. Must be a homeowner and a well-qualified member.

*9.55% APR - Must be a homeowner and a well-qualified member.

* PERSONAL LOANS. APR is Annual Percentage Rate. Promotional rates are for well qualified members having a credit score of 680 and above. Rates indicated are the lowest rates. Quoted APRs are subject to change daily at the discretion of the Board of Directors. Open to all members who are eligible under current POCUMD underwriting guidelines. Limited-time offer runs from 4/1/25 thru 6/30/25. Contact Credit Union for details.

Debt Consolidation Loan - 9.55% APR*

Make Life Easier. One Payment. One Low Rate.

Tired of juggling multiple high-interest credit card payments? Simplify your finances with our Debt Consolidation Loan at an unbeatable 9.55% APR. Combine your debts into one easy payment with one low rate, and start saving today!

But that’s not all—this loan is here to help with so much more! Whether you’re planning a big event, tackling home improvements, managing unexpected expenses, or even dreaming of travel, we’ve got you covered.

With flexible terms, fast approvals, and a process designed for your convenience, you can focus on the things that matter most—without the stress of high-interest debt holding you back.

Consolidate and save!

Rate: 9.55% APR*

Loan Amount: $3,000 to $25,000

Terms: 12 to 60 months

No payment for 90 days

Pre-approval in 24 hours

No early payoff penalties

Fast and Easy Application Process

With our online application system, you can easily apply for your loan from the comfort of your home or on the go. Say goodbye to lengthy paperwork and endless waiting. POCUMD ensures that your application is processed swiftly, getting you one step closer to making your life easier with fewer payments and more money in your wallet!

* PERSONAL LOANS. APR is Annual Percentage Rate. 9.55% rate for qualified members having a credit score of 680 and ablove. Rates indicated are the lowest rates. Quoted APRs are subject to change daily at the discretion of the Board of Directors. Open to all members who are eligible under current POCUMD underwriting guidelines. Limited-time offer runs from 4/1/25 thru 6/30/25. Contact Credit Union for details.

FREE Membership

We’ve extended our FREE Membership Offer.

Due to the huge success of our December Free Membership promotion, we’ve decided to extend the free membership offer to all Maryland USPS employees and their families for three more months!

We’re making it easier than ever for you and your family to enjoy the benefits of POCUMD membership.

From now through June 30, 2025, we’re waiving the $10.25 membership fee. Don’t miss this opportunity to unlock low rates, exclusive benefits, and the personalized service you deserve — all for free!

Apply online in minutes or complete the application form and mail, fax, email, or stop by the branch to drop it off. But don’t wait. This offer won’t be extended again.

To join the credit union please apply online or complete the Membership Application form and return it to us via:

Mail - P.O. Box 22911, Baltimore, MD 21203-4911

Fax - 410-727-0929

Email - info@pocumd.org

Drop it off - POCUMD branch location at 900 East Fayette St., Room 606, Baltimore MD 21233

Any questions, give us a call at (410) 727-5469. We’d love to help!

Already a member?

Share the gift of membership with your family members. From now through May 31, 2025, for every family member you refer to the credit union that joins, you will both earn $50. The more you refer, the more you’ll earn - up to $250!

As a POCUMD member, you already enjoy great rates and exclusive benefits. Share the love and encourage your family to join our community. It only takes a few minutes to join online. POCUMD membership is open to all Maryland USPS employees AND their families.

TruStage Insurance Services

Paying too much for Insurance?

You work hard for your money and to keep your budget on track. So why spend more than you have to for insurance you need to protect you and your family? Post Office Credit Union of Maryland members may qualify for discounts on insurance through TruStage.

TruStage works with national companies to help members save without losing any money. And when you save big, it can be easy to switch insurance carriers!

TruStage Products Available to POCUMD Members:

Auto and Home Insurance

Life Insurance

Accidental Death and Dismemberment Insurance - Members receive $1000 at not cost.

TruStage offers a powerful mix of savings and popular, member-friendly benefits:

Credit union member discounts

Nationally recognized companies (Liberty Mutual, CMFG)

Friendly, 24/7-service – even on holidays

With over 20 million protected under their coverages, it’s an established firm that you can trust to protect and add value.

Check our TruStage page for program information and free quotes. Or visit the Post Office Credit Union of Maryland TruStage website page.

Mobile App

Bank on the Go with Our Mobile App

It's never been easier to keep an eye on your finances. In fact, there's an app for that!

Simply search "POCUMD" in Google Play or the Apple App Store to download the official Post Office Credit Union of Maryland app.

Enhanced with more features!

Downloading the app will put your POCUMD account details in your hands. There are so many benefits.

View balances and transfer funds

Mobile check deposits (coming soon)

Open and fund new accounts

Apply for loans

Sign up for e-Statements and Text Banking

Find surcharge free ATMs

Request check withdrawals

Change your address or phone number

Contact YOUR credit union!

Get out your devices and download today!

Online Banking

Bank from Anywhere – Anytime!

Are you ready to take your banking to the next level? With POCUMD Online Banking, managing your money has never been easier—or more convenient!

This FREE service lets you:

Check your balances

View recent transactions

Download monthly statements

Transfer money in seconds

Apply for loans right from your screen

and so much more—all with just a few clicks!

It’s fast. It’s easy. It’s eco-friendly.

Whether you're at home, at work, or on the go, POCUMD Online Banking keeps you connected to your finances 24/7.

Don't wait—log in or enroll today and experience the freedom of online banking!

Questions? We're happy to help—just give us a call at (410) 727-5469.

Message to our Members Retiring from the Post Office

Congratulations on your retirement from the Post Office! You have arrived at an important milestone in your life. You can now stop living to work, and begin working to live!

We also want to thank you for being a loyal member of POCUMD. Remember, retirement from the Post Office does not affect your membership eligibility with the credit union. Once a member, always a member!

To transition smoothly into retirement, please call OPM at 1-888-767-6738 (TDD 1-800-878-5708), Monday - Friday, 7:30 a.m. - 7:45 p.m. Eastern Time to update your allotments. You will need the credit union's routing number (#252076578), followed by your account number. If you do not have the routing number, contact us, and we will provide it for you.

Our friendly staff is more than happy to assist you with any questions or concerns. Call us at (410) 727-5469, Monday - Friday, 8:00 a.m. - 4:00 p.m.

Once again, congratulations on your retirement, and be sure to make good use of your membership with POCUMD. Why not share your secret? Membership is available to all family members! Open an account for your spouse, children, grandchildren, or any other family member.

Note: There is no limit on the amount you may deposit into any of your accounts.

Newsletters

Our newsletters are available in PDF format. PDF is a universal file format that preserves the fonts, images, graphics, and layout of any source document, regardless of the application and platform used to create it. For more information on PDF format, please visit www.adobe.com. Download the latest version of Adobe Reader.